by James Wallace Harris, Thursday, April 27, 2017

Last night on the PBS Newshour Judy Woodruff interviewed Mick Mulvaney, Donald Trump’s Director of the Office of Management and Budget. When Woodruff pointed out that Reagan’s tax cuts didn’t lead to big economic growth Mulvaney looks at Woodruff and pauses. In that moment we see why we’re politically divided. Mulvaney stares at Woodruff as if she had just said the world was flat. Then Mulvaney says she was wrong and quotes figures about GDP growth. Woodruff doesn’t press the point and goes on to other questions.

Who is right? Both views can’t be right. Did Reagan’s tax cuts help the economy or not? Is it a matter of seeing two sides of a coin? Didn’t Reagan’s tax cuts have countless impacts and each side is now using figures from specific impacts to support their political beliefs? Can any one indicator predict future complexity?

Our reality is infinitely complex. The economy is not that complex, but the number of variables is so great that it’s hard to grasp. Liberals are focused on social equality, conservatives are focused on the freedom to get ahead. They each use evidence to support their beliefs assuming reality works the way they want to see it.

For us to ever solve our political polarization problem will require both sides studying the evidence in new ways. Think of understanding the economy like a science experiment. Any scientific journal that ran studies by current liberals and conservatives would be deemed biased. You can’t go into an experiment looking for an outcome. You can’t cherry pick the results to meet your hypothesis. But that’s what polarized politics does all the time.

If you watch the video closely, you can see that Mulvaney’s conviction that the tax cuts will work is equal to any pope’s conviction that God exists. He’s also confident that GDP growth will pay for the tax cuts in the same way liberals are convinced they will only grow the budget deficit.

Basically, conservatives will embrace what Mulvaney says, while liberals will question it. Is there any evidence to support or deny his claims? This is where it gets hard. One of Mulvaney’s basic assertion is we want a 3% GDP growth rate, and under Obama that never happened. Here’s an article from CBS News that supports his claim. That article included this graph:

And if you look at GDP growth rate after 1982 when Reagan’s tax cuts took effect, GDP growth rates did eventually grow above the 3% rate. The Reagan-Bush era ran from 1/81 through 1/93, and before it was over growth rates had fallen below 3%. We had 3% plus growth rates under Clinton, and briefly under the second Bush administration. Isn’t this evidence that growth rates aren’t tied to taxes?

But can you explain the economy with such simple numbers? I’m not trying to explain economics here, I’m trying to explain belief systems. We all suffer the Dunning-Kruger effect when it comes to economics, even economists with PhDs. The above chart might have been all Mick Mulvaney needed to support his faith in tax cuts. But it’s not enough.

Look at these charts that break down GDP in various ways. Instead of looking at one number, overall growth rates, we’re looking at several numbers. And this approach is still incredibly simple. To really understand the problem we need to be an economist working with several supercomputers analyzing trillions of numbers.

Source: http://www.thoughtofferings.com/2010/08/real-gdp-growth-in-us-and-japan-closer.html

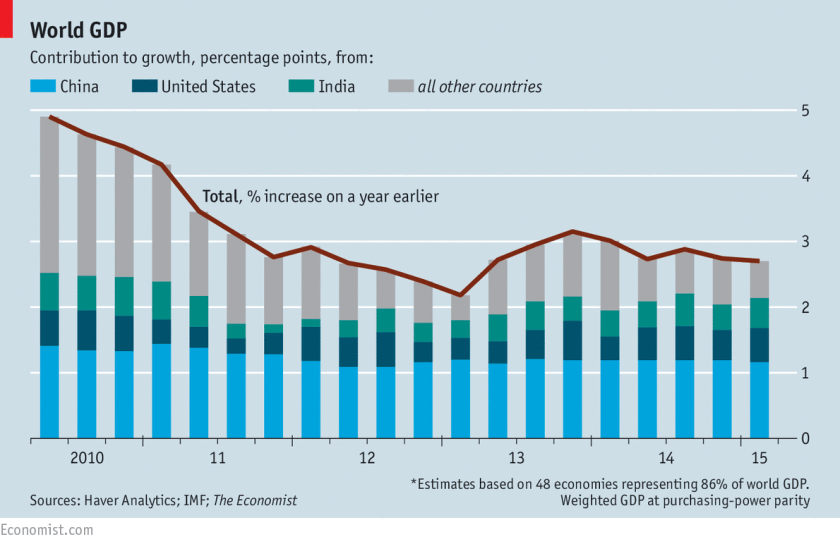

Here’s a comparison to world GDP, which shows GDP growth is related to world GDP growth. In other words, there are many outside factors we have to consider.

Source: http://www.economist.com/news/economic-and-financial-indicators/21654018-world-gdp

This is enough charts to make my point that the issue is more complex than one number. Mulvaney has an undergraduate degree in international economics, but his graduate degree is in law. Then he became a politician. I don’t think he can know what the tax cuts will do. But then, neither will liberal politicians. We’re literally gambling.

I would have trusted Mulvaney more if he had presented 20 factors and charts to make his case. But how many citizens want to sit through such a presentation?

If the average citizen tried to understand the economic evidence they would be quickly overwhelmed. When Mulvaney replies “That’s not true,” when Judy Woodruff tells him the Reagan tax cuts didn’t work I believe he believes that. But I don’t think he knows. I’m not sure anyone knows.

Watch the above video closely. Is it ever about facts and evidence? Isn’t it about one ideology versus another? We tweak the economy every new administration, but how much does that really do? Isn’t the economy really a pinball machine with a quadrillion balls and bumpers? Aren’t major changes dangerous?

I’m tired of meaningless evidence. We need AI minds and armies of supercomputers to analyze the economy. I might trust them, but I don’t think I can trust humans anymore. I can’t even trust my own beliefs. I don’t think humans are smart enough. I’m quite confident that conservatives are wrong, but I can’t prove it. And I’m tired of people with absolute faith in their superiority running the country. Such vain egotism is scary.

What divides us politically is how we react to what we think we know, even though we don’t.

JWH

Reducing taxes is a belief system linked to the conservative mind set. The idea has been framed in the recent past as ‘trickle down’ economics or ‘reaganomics’ during his tenure. Tax reduction works to an extent when the economy is already running in growth mode. However in periods of relatively low growth, most proceeds flow to the 1%. Since in low growth conditions the elites would rather sit on their cash rather than invest as the ROI is not worth the tradeoff.

Tax reductions are appealing to the human desire, even though there is no rational case for this type of policy

What makes the policy a belief system is that the very folks who promote it (conservatives) will do so even when there is no way to pay for it without increasing the debt, which is also a conservative ideal. Just goes to show you how powerful a belief system can be in public life,…no facts or rational thought required.

“Real” wealth is based on the belief that there is a zero point followed by growth of value. If you have something that people want badly enough, they will pay you for it. The more you have, and the more they want, the more you can sell to them. Any gamer will tell you that value is a reference – the gain is as strong or valuable as the Game says it is. As long as there is growth in the Game, wealth increases. The problem is, the foundation of that “value” in the real world is meaningless. Or rather, it is based on a concept that has no meaning in real life. Our current “game” was built on “values” based on our original agrarian societies. When we began to industrialize, the game became much more complicated. In addition to “value” based on raw, real goods, the labor of providing, transporting and improving those goods for consumption changed the math. Since then, whatever “value” a raw commodity may have has been fluffed and multiplied by all the handling, or “improvements” that have accrued to it. Such multiple factors became the basis of mathematics that could describe just what happens in an “economy”. And also explain what the phrase “cornering the market” means.

I have just exposed my level of ignorance on our current belief in “economics”. I do, however know from being involved in both commerce, and a government agency’s operation that bullshit like “trickle-down economics” and most other cheap and easy slogans are just that – bullshit. A bucket of “X” worth $x doesn’t become worth $10x just because it’s been handled 10 times or moved a mile away. Of course, somebody may have cornered the market on “X” and is restricting sales. You can believe in the idea of “free markets” wherein everything is up for grabs on pricing; except for when they are not. And in case y’all haven’t noticed, they are mostly not.

Why are gas prices higher at freeway on-ramps? Because they can charge more when you forget to fill up on Wednesday during the day and have to get to work on Thursday. Sure you can posit that the cost of putting a gas station on a high value corner near a freeway on ramp requires charging a higher price. You can also argue that company owned stations ( i.e. most of them) can spread that expense among all their stations, thus providing a reasonable and fair price for their product at every location. But prices at freeway on-ramps are largely higher than in locations just a mile or two away. Why is that? Based on pricing, nobody would ever stop at a corner station near a freeway on-ramp unless they were too busy to buy gas the day before. Thus, the value of the Location becomes an added factor in the cost of the product – and then also an increase the value of the location.

And of course, you may wonder – what else would be built and paid for on the corner lot at a freeway on/off ramp? Besides a Denny’s?

Does that all make sense to you? Is the gas at the on ramp better and more usable than the gas a mile away? Do you really need to stop at Denny’s for a sandwich? If you let it be so, then that is on you.

The very idea of “ideological” mathematics (as in describing/measuring an “economy”) is worse than bullshit. It’s a fantasy mathematics, corrupted by and infused with belief systems owning (or owned by) the perpetrators. Back in my school days that was called cheating and got you busted for it.

I disagree that this concept or mindset is strictly an outgrowth/belief system of politically conservative people. I do believe however, it is the belief system of those individuals (and corporate entities) who believe that fucking anybody too stupid to avoid them is just a fine thing to do.

I certainly hope there is a difference.

Jim, I think everyone on the political spectrum is fooled by their beliefs. And pricing is closely tied to greed. Everyone thinks they are rational and everyone else is irrational. So its hard to come up with ways to govern that seem fair. If you charge more for gas because the market will bear it, that will seem very rational to you. But the people who think you’re price gouging will think it’s irrational. We use our emotions to measure reality. Because there are no international standards on emotional metrics, we’re constantly at war with each other over fair measuring.

If I was a great programmer I would develop economic models to study. I know they wouldn’t be perfect, but I no longer think humans are capable of analyzing such complex systems. Plus any analysis by humans is tainted by their emotions and beliefs. And aren’t beliefs really ideas we’re emotionally attached to?

Excellent post and replies….all above my head, but excellent nonetheless

Thanks, Mary.

James, I especially agree with your closing paragraphs, about the need to seriously crunch some data. We don’t need ‘belief’ systems and ‘economic theories’ any longer – we have the ability now to crunch huge amounts of data and to guide the economy along the path that analysis of that data would suggest to be most prudent.

These beliefs in ‘trickle down’ or ‘grassroots’ or whatever – are zombie ideas from decades past – there’s no need for the guesswork and religious devotion to a pet theory any longer. Problem is, there’s a huge misinformation machine out there that will push a particular agenda even if the evidence is clearly not in favor of it.

I worry that all of this is proof that humans have reached the limits of their data processing abilities. It appears that Homo sapiens can only process a limited amount of facts before they make up stories about reality. We really aren’t rational creatures, but rationalizing creatures who live by the stories we believe. Our species has adapted to all kinds of environments, but I wonder if it will adapt to the world of data processing. As hunters, we could comprehend our prey. As farmers, we could comprehend our crops and livestock. I’m not sure we managed well in the industrial age, and it appears we’re having, even more, trouble in our current computer age.

Agree totally – we are much happier with stories, I think, and that’s where our political problems lie. Society has perhaps become so complex that simple explanations no longer exist.

The problem with stories is the narrative fallacy. We can’t discern the validity of the stories we make up to explain reality. Anyone who has fallen in love eventually learns much of what they feel about the person they love is made up by themselves. Even in simple relationships, we overlay our beliefs to explain behavior. And we’re incapable of not making up stories.

In recent years I’ve come to realize just how powerful narrative fallacy is in our lives. Other than becoming a Zen master, it’s really hard to ignore our illusions.

This is a very concise and Erudite Article on how people view some of the tax issues. I love how you get your point and how you supported it’s brilliant, I enjoyed reading it.

The one-page TAX PLAN was a joke. It will be as “successful” as the plan to REPEAL AND REPLACE Obama Care. Making decisions on “fake” and “false” information leads to Bad Decisions. No matter how many supercomputers and A.I. software packages, the old GIGO rule still applies: Garbage In, Garbage Out.

If you charge more for gas because the market will bear it, that will seem very rational to you. Based on pricing, nobody would ever stop at a corner station near a freeway on-ramp unless they were too busy to buy gas the day before.

These beliefs in ‘trickle down’ or ‘grassroots’ or whatever – are zombie ideas from decades past – there’s no need for the guesswork and religious devotion to a pet theory any longer. If you charge more for gas because the market will bear it, that will seem very rational to you.

And of course, you may wonder – what else would be built and paid for on the corner lot at a freeway on/off ramp? If you have something that people want badly enough, they will pay you for it.

Tax reductions are appealing to the human desire, even though there is no rational case for this type of policy

What makes the policy a belief system is that the very folks who promote it (conservatives) will do so even when there is no way to pay for it without increasing the debt, which is also a conservative ideal.

I have just exposed my level of ignorance on our current belief in “economics”.